I sometimes use ChatGPT as a tool to aid my understanding of various topics encountered during my family history research. Below is an illustration of this practice.

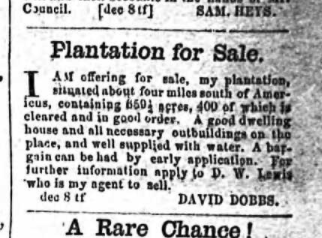

One item that I came across a few weeks ago intrigued me to the point where I could not get it out of my mind. It is an notice that I came across published on more than one occasion in an Augusta Georgia newspaper in the late 1860s. Here it is in the Augusta Triweekly Constitutionalist Newspaper (January 8, 1867)

This is my 3rd great-grandfather, Col. David Dobbs, putting up for sale property that he owned down in Americus County, Georgia.

The blurb appearing on the far-right column of page 1 is signed by David Dobbs and states “I am offering for sale, my plantation, situated about 4 miles south of Americus, containing 659 ½ acres, 400 of which is cleared and in good order. A good dwelling house and all necessary outbuildings on the place, and well supplied with water. A bargain can be had by early application. For further information apply to D. W. Lewis who is my agent to sell.”

I recall my grandmother telling me that my grandfather’s family owned a plantation that they had to give up because they couldn’t pay the taxes on the property. I was never certain if this story was true, as my grandmother did tend to exaggerate.

It was on this same occasion that my grandmother told me that she had attended the premier of Gone with the Wind in Atlanta in 1939. I’m not sure if that is true considering that she no longer lived in Atlanta in 1939 and was then living in Nashville.

When I saw this I immediately thought of that scene in Margaret Mitchell’s Gone With the Wind, where Scarlet is informed that the tax on Tara has been raised to $300.

I was curious about this and asked ChatGPT: During this time in Georgia who was raising taxes on property and why?

Here is the response:

Excellent question — and it goes straight to one of the key historical tensions Margaret Mitchell was dramatizing.

The scene you’re describing in Gone With the Wind takes place during Reconstruction, right after the Civil War, when Georgia was under military occupation by U.S. forces and governed under Reconstruction policies set by Congress.

Here’s what was happening historically behind that $300 tax on Tara:

🔹 1. Who was raising taxes?

After the Confederacy’s defeat in 1865, Georgia (like other Southern states) was placed under Federal military rule — specifically, Military District No. 3, commanded by General John Pope, and later General George Meade.

Local and state governments had to be reorganized under Reconstruction Acts (1867–1868) before Georgia could be readmitted to the Union.

During this period, taxes were levied by local Reconstruction governments — that is:

- County tax commissioners and assessors,

- Operating under state-level Reconstruction legislatures, which were themselves reorganized under Republican leadership with both white and Black officeholders, many of whom were supported by the U.S. Army.

In Gone With the Wind, the tax increase reflects the authority of these Reconstruction-era county and state governments.

🔹 2. Why were taxes raised so sharply?

There were several interlocking reasons — both economic and political:

💰 A. War devastation and empty treasuries

- Georgia’s infrastructure, public buildings, and tax base had been destroyed.

- The Confederate currency had collapsed.

- The state and counties had to raise money in hard U.S. currency (greenbacks or gold) for the first time since before the war.

- Property assessments were based on prewar values, so the taxes felt enormous relative to people’s actual means.

⚖️ B. Reconstruction costs

- The new governments were funding:

- Public schools (including for freedmen),

- Repairing roads, courthouses, and railroads,

- Rebuilding local administration.

- Public schools (including for freedmen),

- Much of this was financed through property taxes, since land was often the only remaining wealth in the South.

🗳️ C. Political motives (as perceived by white Southerners)

- Many white landowners believed the high taxes were intentionally punitive, designed to force the old planter class to sell off their estates.

- In practice, some Northern speculators and local officials (“carpetbaggers” and “scalawags”) did acquire land from tax sales.

- Mitchell’s portrayal follows the Lost Cause interpretation — that Reconstruction governments deliberately tried to destroy the old Southern aristocracy by taxing them off their land.

🔹 3. The historical kernel behind the “$300 tax on Tara”

When Gone With the Wind says Tara’s taxes were raised to $300, that’s roughly in 1867–68, when:

- Georgia was under military control, and

- The state was in the process of writing a new constitution (ratified in 1868) to regain admission to the Union.

So the “tax man” in that scene ultimately represents the Reconstruction-era state tax assessor, operating under U.S. military supervision. To a landowner like Scarlett, it looked like a Northern scheme to dispossess her family. To the authorities, it was simply rebuilding state revenue and ensuring all property was fairly assessed — including large plantations.

🔹 4. Mitchell’s historical source

Margaret Mitchell knew her Reconstruction history well. She drew this episode directly from:

- Accounts of Confederate veterans and widows who lost land for unpaid taxes in 1866–68, and

- The widespread resentment of what was called the “taxation and confiscation policy” of Reconstruction governments.

In her story, that $300 represents not just a bill — it’s the symbol of the old South’s ruin, a moment when the economic order built on slavery and credit truly collapses.

Your family’s situation was at a real crossroads, intersecting with the wider political evolution at that time! Plus in later years, it was reflected in the cultural phenomenon that was “Gone with the Wind.”

LikeLiked by 1 person